Why Home Sales Bounce Back After Presidential Elections

Why Home Sales Bounce Back After Presidential Elections

With the 2024 Presidential election fast approaching, you might be wondering what impact, if any, it’s having on the housing market. Let’s break it down....

What Makes the Best VA Loan Lender? A Guide for Veterans and Military Families

What Makes the Best VA Loan Lender? A Guide for Veterans and Military Families

Navigating the world of VA loans can feel overwhelming, especially when it comes to choosing the best VA loan lender....

VA Cash-Out Refinance: How to Tap Into Your Home’s Equity

VA Cash-Out Refinance: How to Tap Into Your Home’s Equity

As a veteran or active-duty service member, you have access to one of the most valuable benefits when it comes to homeownership: the VA cash-out refinance loan....

Two Reasons Why the Housing Market Won’t Crash

Two Reasons Why the Housing Market Won’t Crash

But here’s the good news – there’s no need to panic. The housing market is not set up for a crash right now....

The Complete Guide to VA Loan Closing Costs

The Complete Guide to VA Loan Closing Costs

This guide will walk you through the ins and outs of VA loan closing costs, what they include, and how you can manage them....

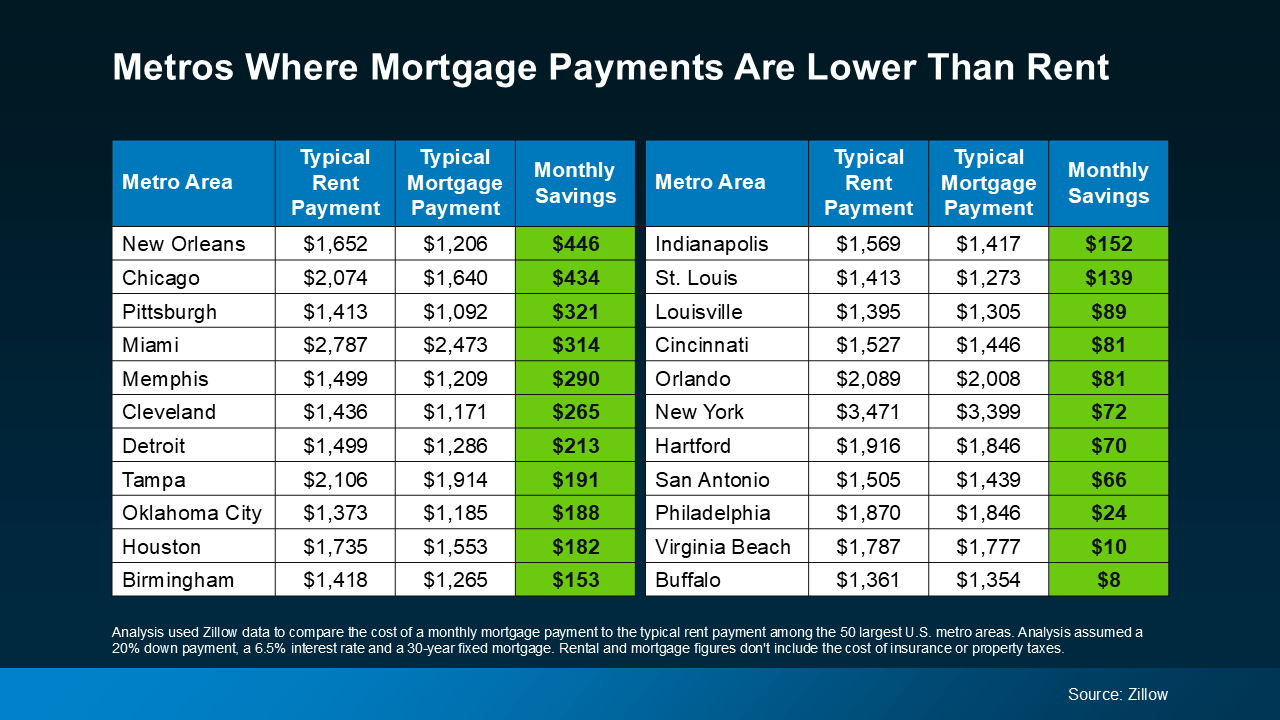

Buying Beats Renting in 22 Major U.S. Cities

Buying Beats Renting in 22 Major U.S. Cities

That’s right—according to a recent study from Zillow, in 22 of the 50 largest metro areas, monthly mortgage payments are now lower than rent payments...

Is Your House Priced Too High?

Is Your House Priced Too High?

Every seller wants to get their house sold quickly, for as much money as they can, with as few headaches as possible. And chances are, you’re no different....

What To Know About Closing Costs

What To Know About Closing Costs

Now that you’ve decided to buy a home and are ready to make it happen, it’s a good idea to plan ahead for the costs that are a typical part of the homebuying process. And while your down payment is probably the number one expense on your mind, don't forget about closing costs. Here’s what you need to know....

Understanding your VA Loan Mortgage Payment

Understanding your VA Loan Mortgage Payment

When it comes to buying a home, the benefits of a VA loan that are available to those who have served our country are fantastic. However, one of the most important aspects of homeownership is understanding your estimated VA mortgage payment. Let’s explore what VA loan payments involve and how you can effectively manage them....

WHAT IS A VA IRRRL?

WHAT IS A VA IRRRL?

A VA IRRRL, or Interest Rate Reduction Refinance Loan, is a refinancing program designed for veterans, active-duty service members, and eligible surviving spouses who already have a VA loan. Commonly referred to as a "VA streamline refinance," its main goal is to reduce your interest rate or switch to an adjustable-rate mortgage (ARM) to a more stable fixed-rate mortgage. ...