In today’s economic climate, inflation is a pressing concern for many. As prices rise, the cost of living increases, affecting everything from groceries to housing. One effective strategy to combat inflation is homeownership. At Arbor Home Loans, we believe that buying a home not only fulfills the dream of ownership but also serves as a financial shield against inflation.

Understanding Inflation and Its Impact

Inflation refers to the general increase in prices and the subsequent decrease in purchasing power. As inflation rises, the cost of goods and services also climbs, which can erode savings and reduce the value of money over time. For renters, this often means facing escalating rental payments without the benefit of building equity.

Homeownership: A Hedge Against Inflation

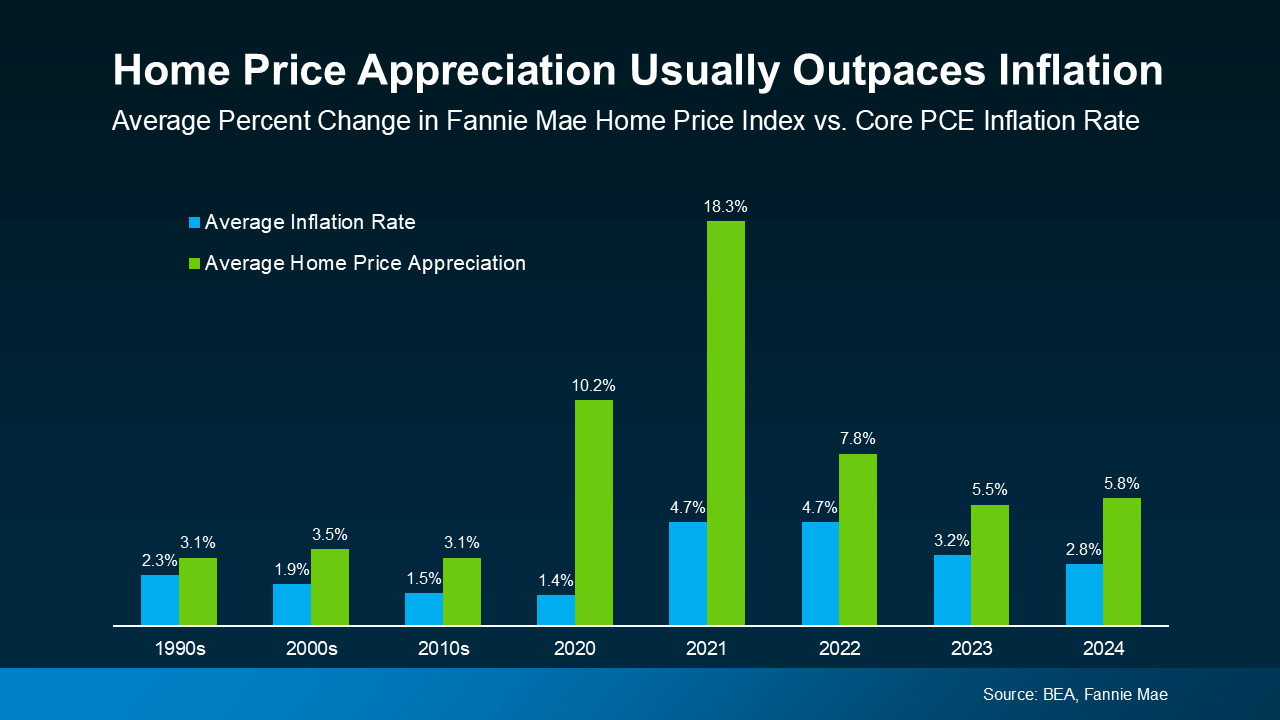

Investing in a home with a fixed-rate mortgage provides stability. Your monthly mortgage payments remain consistent, regardless of inflationary pressures. This predictability allows homeowners to manage their budgets more effectively, without the fear of sudden rent hikes. Moreover, as property values appreciate over time, your home’s equity grows, contributing to your long-term financial security.

Why Choose Arbor Home Loans?

At Arbor Home Loans, we’re committed to helping you navigate the home-buying process with ease. Our team offers personalized mortgage solutions tailored to your unique financial situation. With competitive rates and a dedication to outstanding service, we strive to make your homeownership journey as smooth as possible.

Take the First Step Today

Don’t let inflation dictate your financial future. Explore the benefits of homeownership with Arbor Home Loans and secure a stable, prosperous tomorrow. Contact us today to learn more about our mortgage options and how we can assist you in achieving your homeownership goals.